Before we proceed to

understand comprehensively what is a credit card? First let’s clarify the

simple meaning and/or glossary of some basic terms.

16 important basic terms

and/or points related to credit card are as follows:

Credit means to borrow

something from someone, for example, to borrow money from

a bank.

Card is a small flat object

made of a laminated plastic sheet and other materials.

Cardholder is someone to

whom a card is issued and who has an obligation to remit all

necessary financial borrowings made on his card. The cardholder may

be an individual or organisation. Here, issued means authorized to make use of

card. The word ‘obligation’ means a moral or legal liability to do something.

Remit implies to pay back the money.

ISO is an abbreviation of

International Organization for Standardization.

IEC is an abbreviation of

International Electrotechnical Commission.

NBFC is a short-form of

Non-Banking Financial Company.

ISO/IEC 7810 is an

international standard that specifies (sets or defines) physical

characteristics like size, thickness, etc. for identification cards.

ISO/IEC 7811 is a set of

nine standards ranging from 7811-1 to 7811-9. It specifies traditional data

recording techniques to be used on the magnetic stripe of ID-1 format

identification cards.

ISO/IEC 7812-1 is an

international standard that specifies a card numbering system for

identification cards. It is used to identify a card issuing entity like a bank

or NBFC.

ISO/IEC 7813 is also an

international standard that specifies the data structure and data content of

Track 1 and Track 2. These tracks are located on the magnetic stripe of an

identification card and are used to start (begin or initiate) financial

transactions.

Embossing is a process in

which raised numbers, letters, figures, etc., are embossed (i.e. molded or

craved) on an identification card.

Checksum is a single-digit

generally added at the end of a credit card number to check (validate) the

authenticity (genuineness) of it.

Credit Limit is the maximum

amount up to which a lending entity such as a bank or NBFC can lend (give)

money to its customers. It is further divided into two main types, viz., cash withdrawal

limit and credit-transaction limit.

Cash-withdrawal limit is the

maximum amount of cash that can be withdrawn through a credit card.

Credit-transaction limit is

the maximum limit set on credit transactions (of purchases) that can be done

through a credit card.

Usually, cash withdrawal

limit is less than the credit transaction limit.

We have just finished

discussing the essential glossary (introductory part) of this article. Now

let's move ahead to comprehend the meaning of credit card.

What is Credit Card? Meaning

To know, what is a credit

card? First let’s see how it looks like.

.

The meaning of credit card

is broadly covered in following six points:

Credit card is a

plastic-card issued by a bank or non-banking financial company (NBFC) ready to

lend money (give credit) to its customer.

Basically, it is a

synthetic-card made from a laminated plastic sheet and other materials like

paints, magnetic stripe, microchip (IC), gelatin, hologram, etc.

It entitles (authorizes) the

customer to buy goods and services from merchants, traders and other parties,

based on credit sanctioned to him (customer, who is a cardholder).

It shall be used within a

prescribed credit limit. This limit is based on the earning capacity and

creditworthiness of a cardholder as communicated (settled) by an entity (bank

or NBFC) issuing it to its customer.

It gives a customer a

suitable choice to plan payments for goods and services that may be most

necessary to him on a day-to-day basis.

By using it, customer

promises the repayment of credit transactions executed by him. Such a repayment

along with interest (as applicable) shall be paid to bank or NBFC at a later

agreed (contracted) date. Generally, repayments along with an applicable interest

are made either after a period of 30-45 days or are done on a monthly billing

basis.

Definition

of Credit Card

Definition

of Credit Card

Credit card can be defined

in many ways with different senses. It is difficult to give a perfect

definition of credit card. Following statements are attempts to help you derive

its narrow and broad meaning.

1. In General sense,

“Credit card is a suitable

alternative for cash payment or credit payment or deferred (installment)

payment. It is used to execute those transactions which are compiled through

electronic devices like a card swapping machine, computer with internet facility,

etc.”

2. In a Financial perspective,

“Credit card is a facility

provided by a bank or non-banking financial company (NBFC) which gives its

customer a preference to have a short-term borrowing of funds usually at the

point of transaction (while purchasing something or carrying out sale).”

3. In terms of Business,

“Credit card is a laminated

plastic card issued by a bank or non-banking financial company (NBFC) to give

its cardholder a preference to borrow funds on a short-period basis. Interest

is imposed for lending short-term finance to the cardholder. This interest is

generally charged either after a month or 30-45 days later, once credit-card

transactions have occurred. The card limit is pre-communicated in written

correspondence with cardholder.“

Size of Credit Card

Size of Credit Card

Standard size of credit card

issued by a bank (or NBFC) is depicted below.

The average dimensions of a

credit card in inches, mm and cm:

Credit card has a height of

2.125 inches (53.98 mm or 5.4 cm).

It has a width of 3.370

inches (85.60 mm or 8.5 cm).

Its thickness is of 0.030

inch (0.76 mm or 0.076 cm).

Its four corners (edges) are

rounded with a circle of radius (r) measuring 0.125 inch (3.18 mm or 0.318 cm).

The above measurements

(sizes or dimensions) are averages of the maximum and minimum values defined

for credit cards using ID-1 format of ISO/IEC 7810.

ISO/IEC 7810 is an

international standard that specifies physical characteristics like size,

thickness, etc. for identification cards.

The identification cards

used for banking purposes include ATM, credit, debit cards, etc. These are

helpful to carry out quick financial transactions on a day-to-day basis.

Though ID-1 format of

ISO/IEC 7810 international standard is widely followed globally, variations may

rarely occur from country to country and even from one credit card issuing

entity to another.

Anatomy of Credit Card

Anatomy of Credit Card

The anatomy of credit card

can be studied by analyzing its front & back side.

Image credits © Prof. Mudit

Katyani.

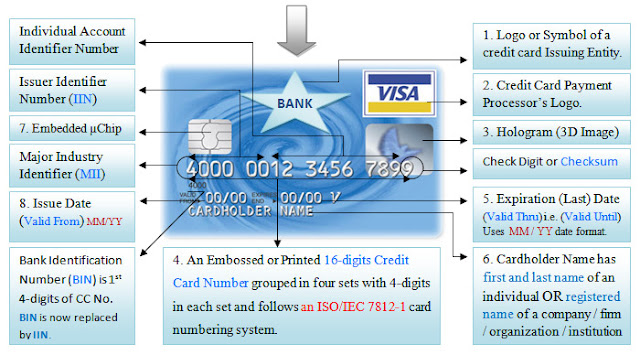

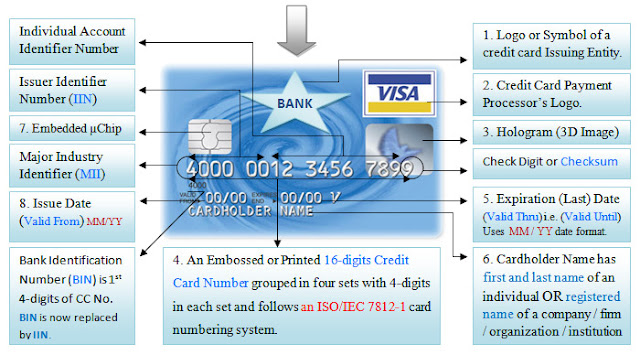

1. Sample image of face or

front side of a credit card.

Image credits © Prof. Mudit Katyani.

The front side of a credit card shows following details:

Logo of issuing entity.

Logo of payment processor.

Hologram.

Expiration date.

Cardholder’s name.

Card number.

Individual account identifier number.

Issuer identifier number (IIN).

Embedded microchip.

Major industry identifier (MII).

Issue date

Bank identification number (BIN).

2. Sample image of rear or back side of a credit card.

Image credits © Prof. Mudit Katyani.

The back side of a credit card shows following details:

Security code (card verification number).

Magnetic stripe.

Signature panel.

Additional information.

Now let’s discuss all details of credit card.

1. Logo of issuing entity

Logo of an issuing entity (which is either a bank or

NBFC) is a unique graphic mark.

The features of logo of an issuing entity:

Logo is an emblem of the entity which issues a credit

card in order to lend money to its customers.

Its main purpose is to ease and aid instant public

recognition of the issuer.

It’s a symbol which helps people quickly identify the

name of bank or NBFC that has issued a credit-card.

2. Logo of payment processor

Generally, a bank issues a credit card in collaboration

with some payment processing company. To indicate this tie-up, bank on its

issued cards also puts (mentions) a logo of its partnered card payment

processor.

Payment processor logo helps a cardholder (user) to

identify which payment processor will process and compile his credit card’s transactions.

It also helps him to choose an appropriate payment processor while shopping and

filing payment forms.

Some leading credit card payment processors:

Visa,

MasterCard,

Discover,

American express (AMEX), and

Japan credit bureau (JCB).

3. Hologram

Hologram is a 3D image either of an object, individual or

some special symbol that has been projected and captured on a 2D flat surface.

Important reasons why a hologram is used on credit card:

Hologram is mainly used as a seal of originality.

It helps to authenticate a genuine brand from counterfeit

one.

It aids in distinguishing an original credit card from

fake (dummy) cards.

It acts as one of the security measures to avoid and/or

minimize forgery.

4. Card number

Card number is a long and unique number assigned to a

credit card. Often, it is embossed (raised) on the face (front-side) of a card.

Generally, it is 16-digits in length and can be extended up to a maximum limit

of 19-digits. An ISO/IEC 7812-1 card number is typically sixteen digits long

and is grouped in four sets with four digits in each set.

An ISO/IEC 7812-1 card numbering system consists of:

Major industry identifier (MII) digit value,

Bank identification number (BIN) now replaced with an

issuer identifier number (IIN),

Individual account identifier, and

Checksum or check digit.

First single-digit (from left) of a credit card number is

a ’Major Industry Identifier (MII)’ digit value. MII digit value or number

signifies the category or type of the entity that issued a card.

Note: please click on the image under section ’Anatomy of

Credit Card’ to get a zoomed preview and find out where exactly is MII digit

value located.

Refer table below to identify which MII digit represents

which issuer category.

First set of four-digits (which also includes MII digit

value) of a credit card number is referred as ’Bank Identification Number

(BIN)’. It is printed in small fonts just below the card number and is located

on its front-left side.

First-six digits of a credit card number (including the

single MII digit value) represents an ’Issuer Identifier Number (IIN)’ of a

card issuing entity. It is required to operate in the global, inter-industry and/or

intra-industry interchange.

As per ISO/IEC 7812-1, ’BIN is now replaced by IIN’.

Following paragraph explains the reason why IIN replaced

BIN.

With the rising demand and recognition of credit cards,

the financial institutions opined the replacement of BIN with IIN. The purpose

of such replacement was to cover wider areas of financial services, to bring

various service providers under one roof and also to ease their identification.

The IIN number consists of initial six digits when compared to BIN, which

consists of starting four digits only. The incorporated change results in more

prompt and proper assistance to compile and execute the credit card processing.

Digits starting from seventh position up to the second

last position (7 to (n-1)) makes an ’Individual Account Identifier’. Here, n

equals the total number of digits found in a credit card number.

For example, if n=16, then the individual account

identifier number would start from 7 to (16-1) i.e. from seventh position to

the fifteenth position.

The individual account identifier number is variable in

length and can reach up to a maximum of 12-digits.

Final (last or ending) single-digit of a credit card number

is known as a ’Check Digit’. It is also called as a ’Checksum’.

As per ISO/IEC 7812-1, the check digit or checksum is a

digit added to the end of a card number that helps to verify (confirm) its

accuracy and/or validate its authenticity (genuineness). Most card numbers

encoded with this digit use a LUHN Formula which is based on ’LUHN Algorithm’

or a ’MOD-10 method’.

Thus, ISO/IEC 7812-1 credit card numbering system gives

details on; the type of industry, of an issuing entity, customer’s information,

check digit, etc.

5. Expiration date

Expiration date of a credit card is the last date until

which a card remains valid and can be used.

This final date of validity is also referred as ’VALID

THRU’ and is read as ’valid through’.

It uses a MM/YY date format where MM implies a Month and

YY stands for a Year.

For example, if 12/22 is mentioned on a credit card, then

it is valid until 12thmonth of year 2022 i.e. its ’VALID THRU’ date is December

2022. In other words, we can say that the card will get expired and lose its

usability on 1stJanuary 2023.

6. Cardholder name

Cardholder name is a given string of embossed or printed

alphabets on a credit card. It either mentions first and last name of an

individual or specifies the registered name of a company, firm, or an

organization holding the account.

To complete online (the internet) transactions, it is

mandatory that name on the credit card must match its cardholder’s name.

7. Embedded microchip

Embedded microchip is usually located on the front side

of a credit card.

Following are important features of microchip:

Microchip is an electronic storage device which is

commonly known as a semiconductor memory.

It acts as an enhanced protection shield of a card that

safely stores confidential credentials of a cardholder. The credentials stored

in an embedded microchip includes PIN (Personal Identification Number), details

of a credit card issuing entity, etc.

It provides a comprehensive security to prevent cloning

or duplication of a credit card.

It encrypts the sensitive data it stores. If hackers scan

a credit card with some electronic spying device, then they will only fetch

encrypted junk and not the original information that microchip contains. This

encrypted scrap is almost useless to them as it is very difficult to decode and

misuse it intentionally.

It has a superior semiconductor memory and a good

processing capacity.

Thus, it acts as a mandatory and essential security

feature of a credit card.

8. Issue date

Issue date of a credit card is the starting date from

when a card becomes valid and gets ready to be used by cardholder.

This starting date of card’s validity is also referred as

’VALID FROM’.

As like an expiration date, issue date also uses a MM/YY

date format.

For example, if 01/15 is mentioned on a credit card, then

its validity started from the 1st month of year 2015 i.e. its ’VALID FROM’

date is January 2015. In other words, we can say that the card became

officially valid and got ready to be used on 1st January 2015.

9. Magnetic stripe

Magnetic stripe is also sometimes called as ’mag-stripe’

or ’swipe card’. Generally, it is located on the back side of a credit card. It

comes in three different colors viz., black, brown, and silver. It is a storage

device and is further internally divided into three horizontal stripes known as

Track 1, Track 2, and Track 3.

ISO/IEC 7811 is an international standard that specifies

the traditional data recording techniques to be used on the magnetic stripe of

identification cards like credit cards.

According to this standard, the data recording density on

Track 1, Track 2, and Track 3 must be 210 bpi (bits per inch), 75 bpi, and 210

bpi, respectively. In other words, Track 1, Track 2, and Track 3 must be 8.27

bpmm (bits per mm), 2.95 bpmm, and 8.27 bpmm, respectively.

The data recorded on Track 1 and Track 2 of the magnetic

stripe contains details of the cardholder’s account. In other words, these

tracks contain details of a credit card number, name of the cardholder, its

expiry date and the issuer’s country code.

Track 1 mostly contains record of an alphabetical value

which is always a credit cardholder’s name and his related information.

Track 2 of magnetic stripe has CVV1, CVC1, CAV1 and CID

code of Visa, MasterCard, JCB, American Express, respectively, encoded on it.

Track 3 is either non-existent or empty or may consist of

some supplementary information about the credit cardholder and is hardly used

for some validation process.

Now with continuous improvement in the technology,

magnetic stripes are getting obsolete as new contact-less credit cards are

emerging in the market.

10. Security code

Security Code is also referred as a card verification

number or value. It is unique from any other number found on a credit card.

Generally, it is a 3-digits number, but sometimes it may even be a 4-digits

number.

Card security code gives an additional layer of security

to the credit card. It helps to check and confirm the physical accessibility of

the card. This prevents an unauthorized card access and minimizes online

frauds.

The card security code is named and abbreviated

differently by various card payments processing companies. Visa, MasterCard,

American Express and JCB call it as CVV2, CVC2, CID, and CAV2, respectively.

CVV2 is an abbreviation of ’card verification value two’.

CVC2 is an abbreviation of ’card validation code two’.

CID stands for a ’card identification number’.

CAV2 can be expanded as ’card authentication value two’.

In case of Visa, MasterCard and JCB, card security code

is a 3-digits number and is generally printed on the rear or back side of a

credit card.

However, in case of American Express, it is a 4-digits

number which is usually printed on the face or front side of a credit card.

11. Signature panel

Signature panel is a rectangular space located on the

back side of a credit card. As it name says, it is a reserved place where a

cardholder must put or sign his authorized signature. It must be signed by the

holder with a good permanent marker pen. For this purpose, a pen with

dark-colored ink preferably blue or black must be used.

Following are important features of having a signature

panel:

It is an added feature for customization and security of

a credit card.

It allows the merchants and/or traders to validate the

authenticity of person using a credit card. It helps them to cross check

whether the physical-signature in the transaction invoice matches with the

signature on the back of a card.

It is mandatory that signature panel must be signed

properly else the credit card is not considered as a valid one. Generally, this

message is warned on its top-right corner with printed statement like,

“NOT VALID UNLESS SIGNED.”

12. Additional information

Additional information is also printed on the back side

of a credit card. Mainly, it contains useful details about; the service

disclaimer, official address of card issuing entity, and toll-free telephone

number for customer service.

Service disclaimer acts like a legal acknowledgement

(acceptance) for an agreement on the terms and conditions between a credit card

issuing entity and the cardholder.

Address of an issuing entity gives official mailing or

contact information of the bank or NBFC that issued a credit card to its

customer. If anyone is in possession of a lost and found card, then in such a

case, this address helps a possessor to surrender the lost card to its original

issuer.

Customer service is generally available via an official

toll-free telephone number. This service helps a cardholder to get his

card-related queries resolved, seek an immediate additional guidance (help)

regarding usage of credit card, register complaints, alert frauds, and also to

contact an issuer on various important matters arising on a day-to-day basis.